Over the past few decades, we witnessed a massive surge in the insurance sector. The companies who embraced digital transformations grow enormously, and the companies who are still with the same old-fashioned ways to work and create their strategies have sunk. The reasons are simple. The lifestyle has become sophisticated, and people have become more engaging and busy. People want everything done immediately, from making insurance to claiming it at the right time; they cannot wait more than the minimum time.

It’s impossible to manage everything without a database and all personal details. However, with all trending technologies like data science, artificial intelligence, and machine learning, it’s easier to either claim or avail of the service. Through a web portal site or their dedicated app, you can use your registered email address and password to log in and do your needs. With supporting documents, now you can claim sitting from home and get your benefits no matter where you are.

Why Is The Demand For The Insurance Sector On The Rise?

The demand for insurance sectors is on the rise because insurance is no more limited to life only. It’s expanding its branches and sub-branches from one to another. The various types of insurances are – car insurance, home insurance, life insurance, disability insurance, long-term care insurance, liability insurance, etc. Even insurances are costly, and you would not get the return from it unless something terrible happens to you, and you claim it.

With the evolution of technologies, the way of living has become simpler yet complicated. We need insurance for everything, yet we neglect it the most in our life. In most cases, people learn about it when they see something tragic happen, and the one who is claiming is getting all the benefits from it. They know how important it is and do it the next day to secure everything they have in life.

How Data Science Helps The Insurance Sector In Growing?

Data science applied in the insurance industry is at an emerging stage. Many companies and industries rely heavily on statistical methods to predict the risks through predictive analytics. Insurance companies are yet to use these advanced techniques using data-driven technologies.

You can become a data scientist in the insurance industry. And give them hidden insights on how they can reach more customers.

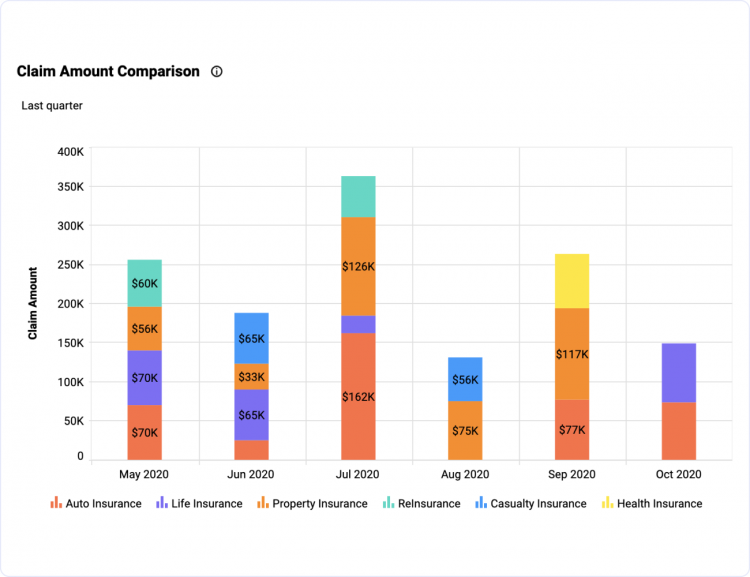

How does Time Series Analysis help in Claiming Insurance?

The insurance claim in a given period is based on the time series analysis model. The insurance claims value gets calculated and combined with the number of claims for that model. Therefore, using past data, it’s easy to predict the random values of a particular sum. Therefore, businesses and customers can have the most benefit from the plan. It also shows how to extend the insurance period by introducing some new variables through time series analysis.

Here are six ways the insurance sector will leap due to data science in 2021. Let us explore them in more detail.

Insurance Costs and Selection Risks

Many many thanks to predictive analytics and advanced data science, 2021 is a year for a change. And you can notice some massive improvements in pricing and selection risks for increased and a variety of data sources, and more actionable data collected by insurers.

The various sources of data are feedback that got collected from social media. Interactions between claims specialists and customers have a big database of first-hand information, and they extract valuable insights from it.

Insurance Claim Predictions and Resolutions

Data science in insurance can identify claims that suddenly cause high losses, such as outlier claims. Insurance companies can review previous claims with proper tools for analytics and through which they can send alerts to specialists. In case there is any problem with the firms’ products. Or services in the future, or if the company gets blamed for something. If some issues are present after earlier claims, the historical data will help them prove their claims.

Statistics play a crucial role in insurance sectors to avoid all these issues regarding claim predictions and resolutions.

Predicting Customers at Risk of Cancellation

Identifying customers who require unique attention is highly essential in the insurance sector. Data science makes it easy to predict customers who are unhappy with the services. And who is more likely to cancel or lower the insurance coverage. Therefore, it becomes easy to reach out to them and provide personalized attention to solve potential issues without prediction. There is a high likelihood the insurers will miss the warning signs and valuable time to solve the issue.

Identifying the Risks of Agent Frauds

Insurance companies always battle with various fraud instances, and many times they fail mostly. According to a recent survey, the insurance sector faces $80 billion of losses from fraudulent claims. They use social media channels to collect the information about claimed data, which may be considered as the activity for the red flags. Therefore insurers rely on different fraud detection models to identify various mismatches between various parties associated with it.

Identifying Potential Markets For Better Targeting and Conversion

Through advanced data science, insurance sectors can identify and effectively target potential markets. Data can get used to predict the behavior patterns and demographics of potential audiences and develop new insurance policies that target them. So there will be more conversions. Companies and people can get more benefits from it.

Providing Personalized Experience That Customers Love The Most

Customers love when they get personalized messages, even if they end up making more conversions. From advanced data science, insurers forecast and gain actionable insights into different aspects of their business. It offers a competitive advantage over competitors and can provide seamless customer services, thereby saving precious resources.

Conclusion

All the trending technologies like data science, artificial intelligence, machine learning, behavioral analytics helps insurers to find their right and potential audience. And to thrive in a competitive market. Where the competitors are too high, and frauds are rampant. Here, it’s more crucial to win people’s trust by answering their queries and providing them with the best customer experiences.

Author Bio

Senior Data Scientist and Alumnus of IIM- C (Indian Institute of Management – Kolkata) with over 25 years of professional experience Specialized in Data Science, Artificial Intelligence, and Machine Learning.

PMP Certified

ITIL Expert certified APMG, PEOPLECERT and EXIN Accredited Trainer for all modules of ITIL till Expert Trained over 3000+ professionals across the globe Currently authoring a book on ITIL “ITIL MADE EASY”.

Conducted myriad Project management and ITIL Process consulting engagements in various organizations. Performed maturity assessment, gap analysis and Project management process definition and end to end implementation of Project management best practices.

Social Profile Links

Twitter account URL – https://twitter.com/ramtavva?s=09

Facebook Profile URL – https://www.facebook.com/ram.tavva

Linked In Profile URL – https://www.linkedin.com/in/ram-tavva/