Unlike the stock market, which is closed on weekends, the cryptocurrency market is open around the clock.

Additionally, due to its volatility, traders must ensure that they do not miss important trades. So, it is important that they know how to monitor the market. Traders need help because they are unable to respond quickly enough to take advantage of market fluctuations that will enable them to make the best possible trades.

Crypto traders must be alert and ready at all times of the day to make the most trades. Again, some traders may miss out on some good deals due to certain trading exchanges and slow transaction times. Bots for cryptocurrency trading are being used by traders more and more to address these issues.

This article will define Crypto Trading Bots, discuss their benefits and drawbacks, and describe how they operate. It will also feature a few of our best choices.

Crypto Trading Bots: What Are They?

Crypto trading bots are automated systems that use technical indicators to assist you as a trader in trading and trading. You can set up your Bitcoin trading bot to execute trade orders on your behalf, following predetermined rules.

For example, you can instruct your bot to buy a certain currency for $15 and buy it again for $12 if the price drops. Account settings and supported coins are available, depending on the bot provider you use.

The cryptocurrency market’s use of trading bots is controversial. While some believe it should be banned, others say it has some benefits. Well, these are a few applications for it.

- Bots help in automated trading to give traders more time for work, study, business, or other pursuits.

- They are used by investors to profit from the global cryptocurrency market, which is open 24 hours a day.

- Bots have a big advantage over manual trading because they respond to the market faster.

- An arbitrage bot is a special type of bot that exploits price differences between different exchanges.

How Do Trading Bots Work?

Other traders have started using trading bots, although other investors are still divided on whether or not they should be allowed in the Bitcoin space. Every bot has different needs in terms of both software and hardware. Certain bots can be used for free, but others need a high membership cost in order to function.

When traders find a bot that will help them, they usually download a code from the bot’s developer. Now, the trader will follow the guidelines and configure his bot on the desired exchange.

Even with the help of bots, traders still need to decide when to buy and when to sell. A cryptocurrency trading bot is not a get-rich-quick way. This is not a gadget that will guarantee you success in every trade once you get it. To be very successful in your trading, you still need to commit and invest the required time, energy and knowledge.

Advantages and Disadvantages of Using a bot

Setting aside emotions is necessary while trading cryptocurrencies. You might want to think about utilizing a trading bot if you feel that you are unable to control yourself and that you purchase and sell obsessively.

These are some of the benefits of using a cryptocurrency bot. 👍

Automated Trading: You can invest and trade automatically with a cryptocurrency trading bot, which can help you avoid making hasty decisions. A trader who is not using a bot can also lose money due to FOMO buying and selling. A trading bot helps you avoid all these potential loss-causing variables.

Efficient and Fast: Trading bots are quick and easy for cryptocurrency traders. A trade can take minutes or even hours to complete if you trade manually. However, using a bot gives you speed and accelerates your ability to identify prospects.

More time for you: You cannot see trades day and night as the cryptocurrency market is open round the clock. However, a cryptocurrency bot can help you trade the market 24 hours a day, seven days a week. That way, you can spend a lot of time in the market without actually being there.

There are certain disadvantages to utilizing a Crypto Trading Bots in addition to its advantages. Among them are:

Monitoring required: Monitoring is important because, even when they are working well, many bots can only make negligible profits. Since you are trading in a very volatile market, you should check it constantly to avoid losses.

Unregulated Industry: Because the cryptocurrency trading bot industry is unregulated, no one is monitoring the vast majority of poorly constructed bots.

Knowledge required: A solid investing strategy and in-depth knowledge of the Bitcoin market are prerequisites for using a bot efficiently. Certain bots have pre-programmed templates, settings, and strategies, but you still need to know how to use them effectively.

Some traders discover that they are no longer in need of the services by the time they have completed all the requirements to use a bot. Nevertheless, you can utilize these bots with their approved exchanges to automate trades and increase your efficiency.

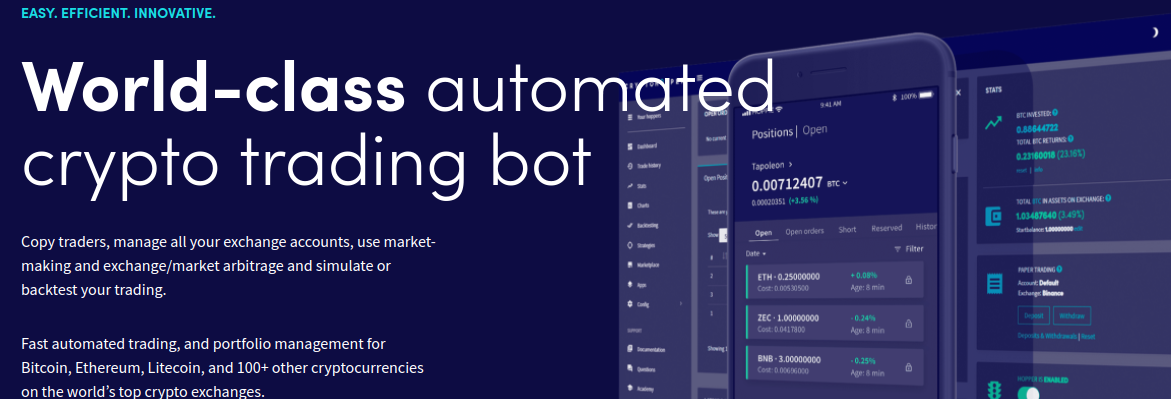

1) Tradesanta

When Tradesanta trades on your behalf, it can save you time as a cloud-based trading bot. It’s easy to set up, lets you automate trades on multiple exchanges, and lets you customize the bot to your desired settings at creation. You can create as many bots as you want using Tradesanta to scale your trading.

Moreover, it is compatible with most of the existing cryptocurrency exchanges.

Exchanges include: HitBTC, Bittrex, Huobi, BitMEX, Bitfinex, OKEx, UPbit, and Binance.

2) Cryptohopper

This cryptocurrency trading bot runs all its functions in the cloud. In this way, it can help you identify short periods of inactivity that may have caused a drop in income.

Additionally, the bot never experiences any downtime, which provides updates without interfering with your business or blocking your account. Your Cryptohopper account will continue to work even if you are not online.

This bot’s simple and straightforward setup process does not require installing any platforms or providing credit card information.

Exchanges: KuCoin, Binance, HitBTC, Bittrex, Bitfinex, Coinbase Pro, Huobi, Poloniex, Bittrex, Bitfinex, and Okex.

3) Botcrypto

With this tool, you can automatically trade cryptocurrency and save time. This software requires no coding knowledge, and you can program and manage the trading robots to execute your trading methods.

Botcrypto is a free bot trading platform with a visual editor and round-the-clock support.

Both Kraken and Binance accept Bot Crypto as a payment method.

4) Axion Crypto

This state-of-the-art, user-friendly cryptocurrency trading bot is designed to help you create complex automated trading algorithms and indicators.

You can use Axion Crypto on a variety of cryptocurrency exchanges and use the code editor and builder to design custom strategies. Monthly costs range from $15 to $90.

With the help of this application, you may send signals straight from the trading view or manual system, keep an eye on custom trades, and backtest novel concepts and trade strategies. Since the bots run on a secure enterprise network in the cloud, there is no need to download and install the platform.

Exchanges: KuCoin, Kraken, Altrady, Bybit, Binance.

5) Trality

Anyone who wants to build highly complex, creative algorithms within a learning environment that is driven by the community can use this platform. Trality is one of the most preferred trading bot platforms available worldwide for both new and experienced cryptocurrency investors.

Trinity offers a tool called Rule Builder if you know how to program advanced trading algorithms. With its sophisticated graphical user interface, you can create your own trading bot logic by simply dragging and dropping indicators and strategies.

Their latest browser-based code editor is available for advanced users who know how to code in Python. Developers use their coding skills with the code editor to design complex and advanced strategies quickly and safely. They offer many programs, from free to premium.

Exchanges: Kraken, BitPanda, Binance, and Coinbase Pro.

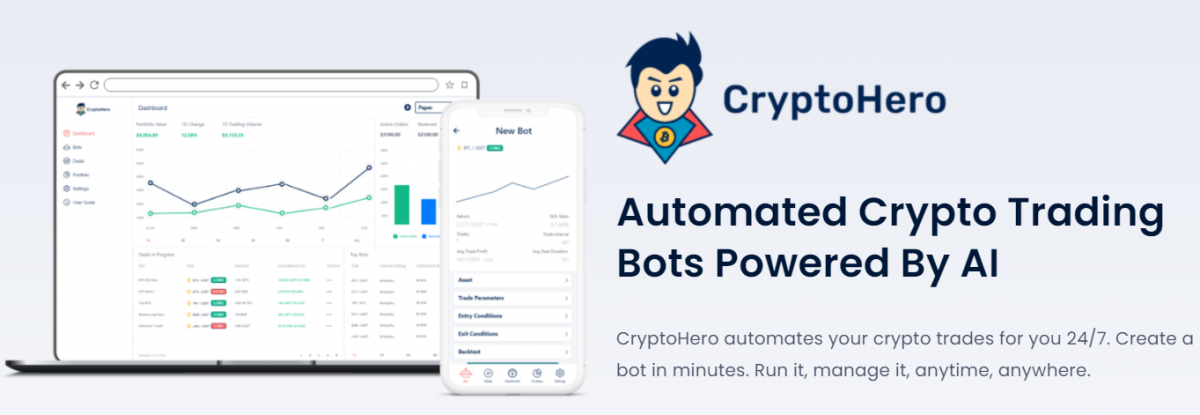

6) Cryptohero

It is a separate platform with a beautiful user interface, mobile app and website. Cryptohero software loads fast is easy to download and doesn’t cause your phone to overheat or use excessive memory. For their users, they offer both a paid platform and a free (basic) platform.

In its mobile app, traders can create their own bot and start trading with the help of a basic tutorial. You can check your dashboard to see the total number of transactions, earned revenue, win/loss ratio, and pending orders. The Deals tab is divided into Ongoing and Completed sections.

Exchanges: Kocoin, Kraken, and Binance.

7) Hodlbot

One of the largest cryptocurrency trading bots is Hodlbot, which offers an intuitive interface to help you manage your trades. You can easily tailor your portfolio to suit your needs using this software to set up a portfolio of over 350 coins. This bot, with monthly costs starting at $3, makes it easy for you to rebalance your portfolio.

Your portfolio is automatically managed by this cryptocurrency bot. This bot saves you time and effort when running marketing campaigns by encrypting your data with SHA 256.

Exchanges: Bittrex, KuCoin, Kraken, Binance.

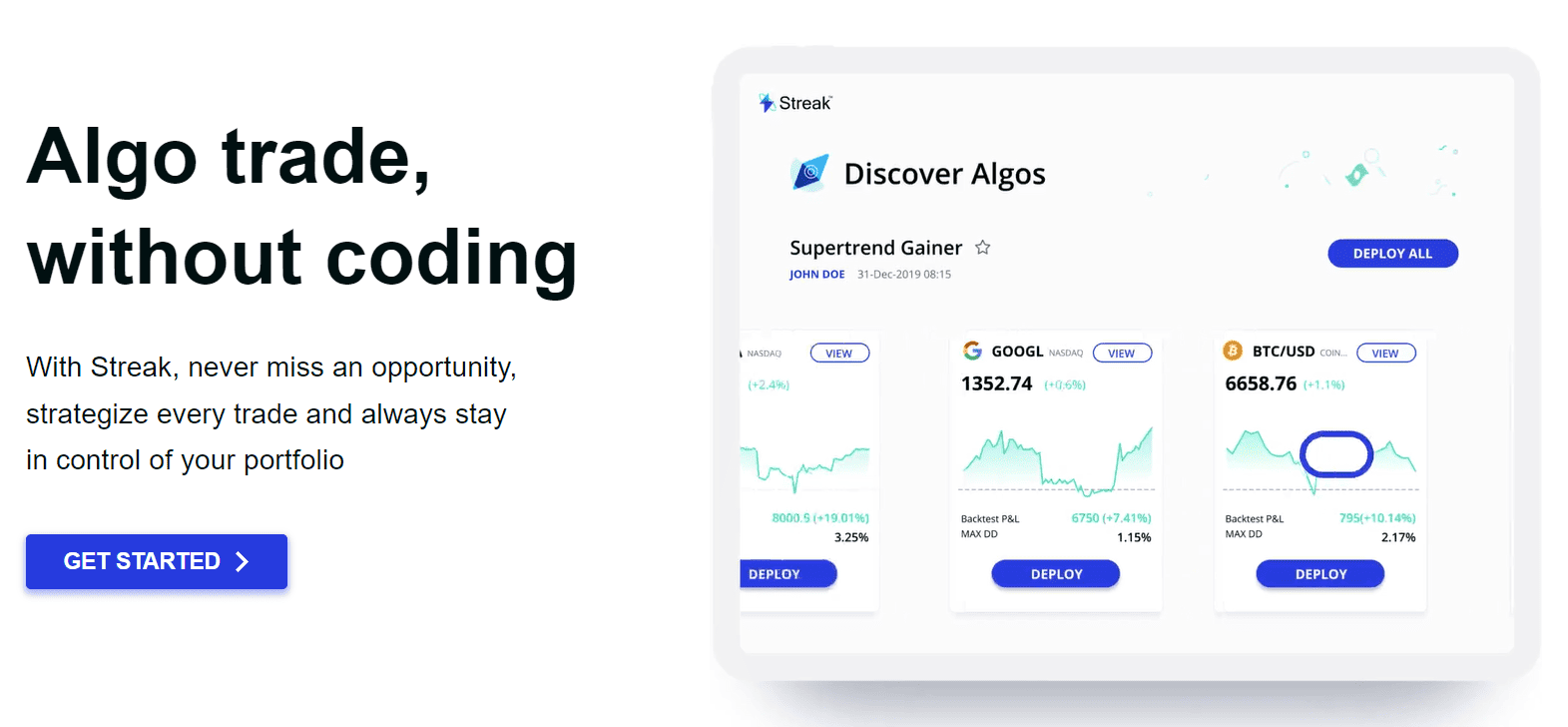

8) Streak

This trading bot for cryptocurrencies helps in backtesting, deployment, and strategic trading decision-making. The Streak bot is suitable for retail traders and does not require coding knowledge. This bot is an automated trading tool designed to help traders make systematic cryptocurrency trades. It is algorithm-based.

For traders, it monitors market fluctuations and helps determine the best entry and exit times. Streak offers a seven-day free trial.

Exchanges: BitMEX, ZB, Coinbase Pro, Huobi, Binance, Deribit, HITBTC, Okex, and Kraken.

9) 3Commas

Using sleepless bots, 3Commas makes it simple to generate revenue. 3Commas allows traders the ability to profit from any market situation, regardless of whether they build a completely bespoke bot or utilize one of their numerous tested templates.

Their extensive selection of DCA, Grid, and Futures bots can manage options, futures, and long and short positions using any method you can imagine. You can choose the template or signal that best suits your objectives from a clear performance history available in the 3Commas marketplace.

Furthermore, 3Commas provides robust trade orchestration and portfolio management features, enabling you to oversee all of your cryptocurrency activities from a single, central interface. With considerably more power and options than exchanges provide, use SmartTrade to execute trades on any major exchange. Utilize the scalping terminal to seize opportunities for rapid financial gain.

BitMEX, Bitfinex, Bitstamp, Bittrex, Bybit, Crypto.com, Deribit, FTX US, Gate.io, Gemini, Huobi, and Kraken are among the exchanges.

10) WunderTrading

WunderTrading is an automated cryptocurrency platform with mirror trading and tools for managing cryptocurrency portfolios. With TradingView PineScript, users may build fully autonomous cryptocurrency trading bots. They can also use the sophisticated trading terminal to trade manually or follow highly talented traders to generate passive cryptocurrency revenue.

WunderTrading distinguishes itself from its rivals with a wide array of trading features. On the WunderTrading platform, you can make use of the Trailing-stop and even Swing-trade features. To enhance trading tactics, you may also make use of sophisticated trading tools like take-profit and stop-loss. The TradingView integration allows you to include a variety of trading algorithms and technical indicators in your bots. You may also use their unique built-in terminals to create DCA and spread strategies.

With WunderTrading, you can oversee multiple exchange accounts from a unified interface. With just one click, you can duplicate trades across all of your exchange accounts after adding them using the API. To help traders monitor their gains and make more informed trading decisions, the platform offers a wealth of data that is calculated and shown on the dashboard.

11) Coinrule

Coinrule is one of the most well-liked bots available since it offers the largest selection of preset trading methods. With over 150 trading templates that are automatically carried out when market conditions match predetermined criteria, it gives customers the ability to personalize their investment strategies. Coinrule frequently adds new templates to its platform, ranging from accumulating to stop-loss settings and long-term holding methods.

Depending on the plan you choose, different amounts of templates are available for both paid and free options. The membership option provides advanced charting features, unlimited template usage, and even one-on-one trading seminars and courses, while the free plan only offers seven free template methods.

Exchanges include: Kraken, BitMEX, Bitfinex, Bitpanda Pro, Liquid, Okex, Binance US, HitBTC, Coinbase Pro, Binance, Bitstamp, Bittrex, Poloniex, and Poloniex.

12) TradeHub

With their 14-day trial, TradeHub is a turnkey cryptocurrency trading bot that you can start using for free. It has innumerable trading methods built from the three fundamental concepts of DCA, Grid, and Short.

TradeHub has extreme security. They encrypt the trade data using the API keys that your exchange has provided, not storing your money.

You also receive a thorough analysis of your trading portfolio, including performance matrices for each strategy.

Connecting the exchange’s API keys and choosing a desired trading strategy are the first steps.

Depending on the quantity of bots and Telegram integration, there are three subscription options. To get started, just $15 is needed.

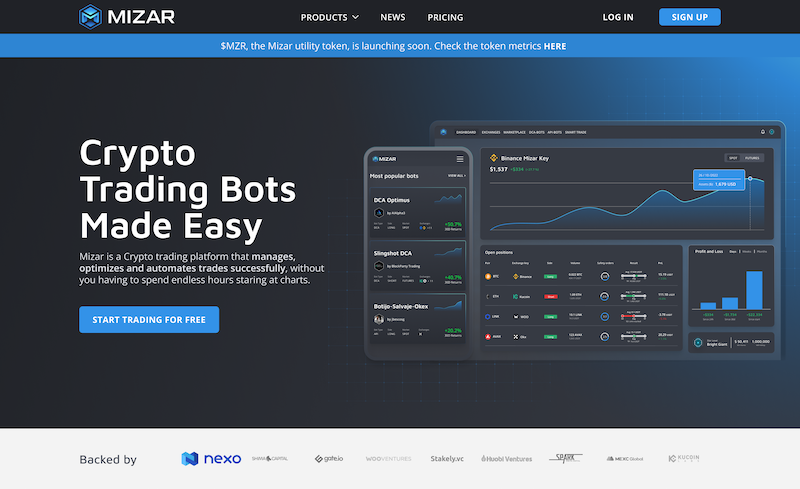

13) Mizar

The only trading bot that offers unlimited access to all the features to help you scale your trades and diversify your portfolio is called Mizar, and it’s 100% free to use. Prominent investors, including Nexo, KuCoin, Huobi, and WooX, support Mizar.

The fact that Mizar is an all-in-one platform for Bitcoin trading is one of its main advantages. Through an intuitive interface, users can develop low-risk strategies and execute orders across multiple cryptocurrency exchanges, markets (spot and futures) and pairs.

Users of Mizar’s smart trading terminal can easily trade, monitor their positions from TradingView or other platforms, and easily create long and short bots. The trading tools provided by Mizar include multiple entry zones, stop loss, take profit, trailing and DCA.

Additionally, Mizar provides a marketplace where users can exchange strategies. With a few clicks, users can emulate the most profitable techniques and trade like a pro. In return, dealers get monthly rewards through a profit-sharing scheme.

Mizar provides unlimited paper trades to new traders to gain confidence without investing real money. Users can test their methods and strategies or learn to trade this way without any risk.

There are no credit cards, subscription fees, platform downloads, or installations required.

Exchanges: KuCoin, OKX, Coinbase, Bybit, Huobi, MEXC, Crypto.com, WOO X, Binance, Binance.com, and KuCoin.

14) Bitsgap

One of the biggest bitcoin trading bots is Bitsgap, which enables you to manage your cryptocurrency holdings easily and quickly create a bot plan.

Ten thousand cryptocurrency pairs can be tested through this program, which will identify the coins with the most promise. Bitsgap allows you to download it, test the settings before trading and observe your trades through charts.

Among the exchanges are Bitfinex, Bibox, Exmo, OKEX, BigOne, Binance, Kraken, DDEX, HitBTC, Bithump, Gate.io, Bitstamp, Liquid, Gemini, Bit-Z, Yobit, and OkEX.

15) Gunboat

Among the most sophisticated commercial boats available is the Gunboat.

The cryptocurrency trading needs of over 25,000 active users are fully automated by this reliable software, which has been continuously updated and added to since the beginning of 2016.

Gunbot is easy to use, quick to set up, and offers a wide range of customizable strategies to suit any type of trader or risk profile. There are even ready-to-use, free, and successful “plug-and-play” strategies available in their marketplace. Gunbot regularly organizes tournaments, which give its users a chance to earn some extra cash.

You may begin trading with Gunbot for just $9.99. Instead of requiring a regular monthly subscription, Gunbot only needs a one-time purchase, in contrast to many of its rivals.

Bitstamp, KuCoin, Poloniex, Cex, Bithumb, HitBTC, Huobi Global, Coinbase Pro, Bittrex, Coinex, Binance, Bittrex US, Bittrex, KuCoin, Bittrex, Bittrex Testnet, and over a hundred additional exchanges are among them.

16) Pionex

With 12 different training bots available at no extra cost, Pionex is a cryptocurrency exchange with integrated trading bots. You can automate your trading approach using these trading bots, eliminating the need for you to constantly watch the market.

For merchants who deal in large volumes and are mobile, this product is a great choice. While Pionex allows human trading via crypto-to-crypto transfers, its core offering is its selection of trading bots. Without the need for human input and under predetermined market conditions, this bot executes traders’ buy and sell orders.

Punex charges according to the model taken by the maker. This means that you only get paid when the trades you make “make” and “take” liquidity from the market. If the outstanding order on the books does not immediately match your trade, you must pay a maker charge. In the event that your order is matched, the pickup charge is due.

Exchanges: Huobi Global, Pionex, Binance,

Closing Words 👩🏫

Working with bots to improve trading strategies has become easier for traders as the cryptocurrency industry gains more attention. You, as a cryptocurrency trader, still need a strong trading strategy to trade profitably, even though bots can help traders to execute trades and take advantage of price differentials between exchanges.